Frequently Asked Questions

Financial terminology

Carmignac and its offering

Socially responsible investment (SRI)

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

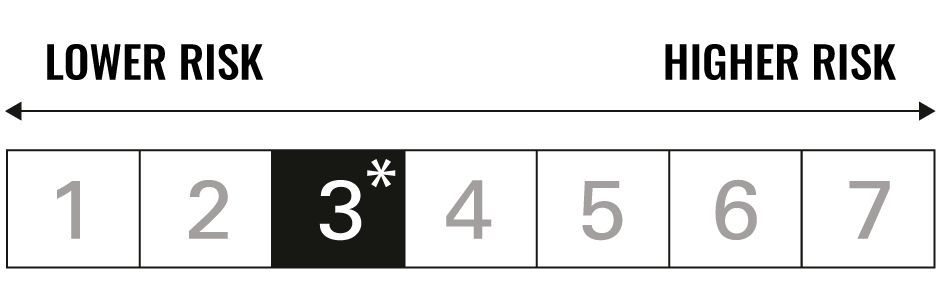

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: [UK](https://www.carmignac.co.uk/en_GB/article-page/regulatory-information-1788 """") ; [Switzerland](https://www.carmignac.ch/en_GB/article-page/regulatory-information-1788 """") ; [France](https://www.carmignac.fr/en_GB/article-page/regulatory-information-3863 """") ; [Luxembourg](https://www.carmignac.lu/en_GB/article-page/regulatory-information-1385 """") ; [Sweden](https://www.carmignac.se/en_GB/article-page/regulatory-information-1788 """")