![[Main Media] [Fund Focus] [UKCEL Campaign] Sun piercing through the clouds](https://carmignac.imgix.net/uploads/article/0001/12/Main_Media_UKCEL-1400x1000.jpg?auto=format%2Ccompress)

FP Carmignac European Leaders

October 2023

Portfolio News

Annualized Return - A GBP ACC shareclass

| 1M | YTD | 1Y | 3Y | Since launch | |

|---|---|---|---|---|---|

| FP Carmignac European Leaders | -4.09% | +2.38% | +9.20% | +3.83% | +9.38% |

| Comparator Benchmark* | -3.04% | +3.51% | +10.66% | +8.90% | +6.14% |

*Comparator Benchmark: MSCI Europe Ex UK Net Total Return USD, converted to GBP end of day. Date of first NAV: 15/05/2019. Past performance is not necessarily indicative of future performance. Performance are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations. The fund presents a risk of capital loss. Source: Carmignac, 31 Oct 2023.

Performance Review

-

TOP 3 CONTRIBUTORS

- NOVO NORDISK (Healthcare) +0.55

- SAP (Technology) +0.19

- ESSILOR INTL (Healthcare) +0.17

-

TOP 3 DETRACTORS

- LONZA (Healthcare) -1.24

- SANOFI (Healthcare) -0.79

- ALCON (Healthcare) -0.44

Notable portfolio moves

- New Positions: Adidas (0.21%), Demant (0.14%)

- Renforcements: Atlas Copco (1.84%), Dassault Systemes (1.76%), Nemetschek(0.38%)

- Reductions: Sanofi (1.54%), Edenred (1.20%), Lonza (2.46%)

- Positions Sold: Sodexo

- Number of Holdings: 35 (target range 35/40)

Positioning

-

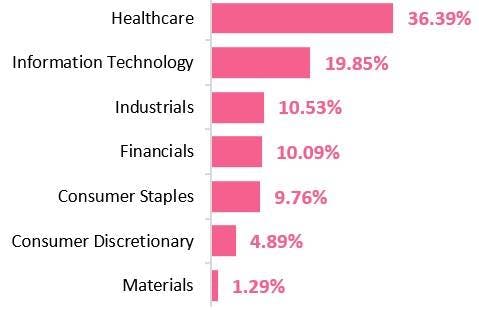

SECTOR ALLOCATION

-

TOP 10 POSITIONS

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. Data as of 31/10/2023. Source: Carmignac, 31 Oct 2023.

Strategy reminder

- Investment Objective: To achieve capital growth over a period of at least five years

- An actively managed and concentrated European ex-UK equity strategy

- 100% bottom-up

- High Conviction: 35 to 40 stocks on average

- A fully integrated SRI approach

Other investment restrictions apply. Please refer to the fund documentation for a complete description of the fund.

FP Carmignac European Leaders A GBP ACC

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

FP Carmignac European Leaders A GBP ACC

| 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|

| FP Carmignac European Leaders A GBP ACC | +18.21 % | +27.10 % | +13.88 % | -14.80 % | +13.90 % | +10.85 % |

| Reference Indicator | +8.77 % | +7.48 % | +16.73 % | -7.62 % | +14.83 % | +6.38 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| FP Carmignac European Leaders A GBP ACC | +4.89 % | +11.50 % | - |

| Reference Indicator | +6.06 % | +7.74 % | - |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Maximum subscription fees paid to distributors : | 0,00% |

| Redemption Fees : | 0,00% |

| Ongoing Charges : | 0.89% |

| Conversion Fee : | - |

| Management Fees : | 0,81% |

| Performance Fees : | 0,00% |