Flash Note

Flexibility and conviction at the heart of your fixed income portfolio

Carmignac Portfolio Flexible Bond

- Published

-

Length

4 minute(s) read

In a complex bond environment characterised by low yields and rising interest rates, what is the best approach for laying a solid foundation for a bond portfolio?

A tried and tested investment process

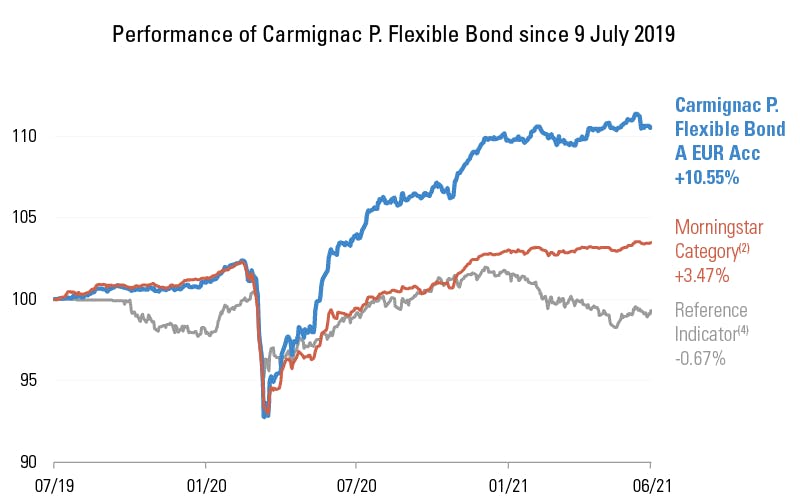

Guillaume Rigeade and Eliezer Ben Zimra, co-managers of the Fund, have been demonstrating the robustness of their investment process, even in complex environments, since they joined Carmignac in July 2019. In addition to their double-digit performance, they recouped the losses that followed the Covid-19 crisis in just 50 business days, compared with 167 for their peer group average, as represented by their Morningstar2 category.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

A strategy with a solid track record

Although Guillaume and Eliezer joined Carmignac only two years ago, they have been working together on this strategy for over eight years and have demonstrated their ability to consistently create value over time. The proof is in the numbers3 :

-

3.8 %Annualised performance over 8 years

1.6% higher than the average of its peers, represented by their Morningstar category2

-

4.1 %Annualised volatility over 8 years

In line with the Fund's mandate (risk scale: 3*)

-

11th percentilein its Morningstar category

For its performance over the last eight years2

Source: Carmignac, Morningstar, 30 June 2021.

(1) The Fund aims to outperform its benchmark, the ICE BofA ML Euro Broad Market Index (coupons reinvested), over a recommended investment horizon of at least three years.

(2) Morningstar category: EUR Flexible Bond.

(3) Annualised performance includes the performance of Guillaume Rigeade and Eliezer Ben Zimra when they were managers of the Edmond de Rothschild Bond Allocation (I Share) fund from 14/02/2013 to 08/07/2019 and the performance of Carmignac Portfolio Capital Plus A Eur Acc (the Fund's former name and strategy) from 09/07/2019 to 29/09/2020. Performance is presented using the chaining method. Past performance is not a reliable guide to future performance. It is net of charges (other than entry charges applied by the distributor).

*For the A EUR Acc. unit Risk scale taken from the KIID (Key Investor Information Document) Risk 1 does not mean a risk-free investment. This indicator may change over time.

(4) Benchmark: ICE BofA ML Euro Broad Market Index (calculated with coupons reinvested). On 30/09/2019 the composition of the benchmark index changed: the ICE BofA ML Euro Broad Market Index with coupons reinvested replaced the EONCAPL7 index.

Carmignac Portfolio Flexible Bond A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

The Fund presents a risk of loss of capital.

Carmignac Portfolio Flexible Bond A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Flexible Bond A EUR Acc | +1.98 % | -0.71 % | +0.07 % | +1.65 % | -3.40 % | +4.99 % | +9.24 % | +0.01 % | -8.02 % | +4.67 % | +3.04 % |

| Reference Indicator | +0.10 % | -0.11 % | -0.32 % | -0.36 % | -0.37 % | -2.45 % | +3.99 % | -2.80 % | -16.93 % | +6.82 % | -1.17 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio Flexible Bond A EUR Acc | -0.43 % | +1.78 % | +1.09 % |

| Reference Indicator | -4.46 % | -2.83 % | -1.56 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Maximum subscription fees paid to distributors : | 1,00% |

| Redemption Fees : | 0,00% |

| Ongoing Charges : | 1.20% |

| Conversion Fee : | 1% |

| Management Fees : | 1,00% |

| Performance Fees : | 20,00% |

![[ISR pages] Picto Analyse [ISR pages] Picto Analyse](https://carmignac.imgix.net/uploads/logo/0001/13/73bf16da363dd0316cf00942970087a4f91559a8.png?auto=format%2Ccompress)