Flash Note

FP Carmignac Global Equity Compounders celebrates its three-year anniversary

- Published

-

Length

4 minute(s) read

FP Carmignac Global Equity Compounders - a global equity fund invested in developed markets through a sustainable approach - is celebrating its third anniversary. This milestone provides a chance to reflect upon the fund's key defining characteristics.

A Fund focusing on “Compounders”

Compounders are high-quality companies that choose to reinvest their earnings sustainably to generate future growth. By investing in compounders, the Fund aims to benefit from profitable business models that reinvest their earnings internally to finance their future growth. By ploughing capital back into their business instead of paying dividends, compounders create additional growth engines, for example through innovation or product development, which allows the company to live on over economic cycles and generations.

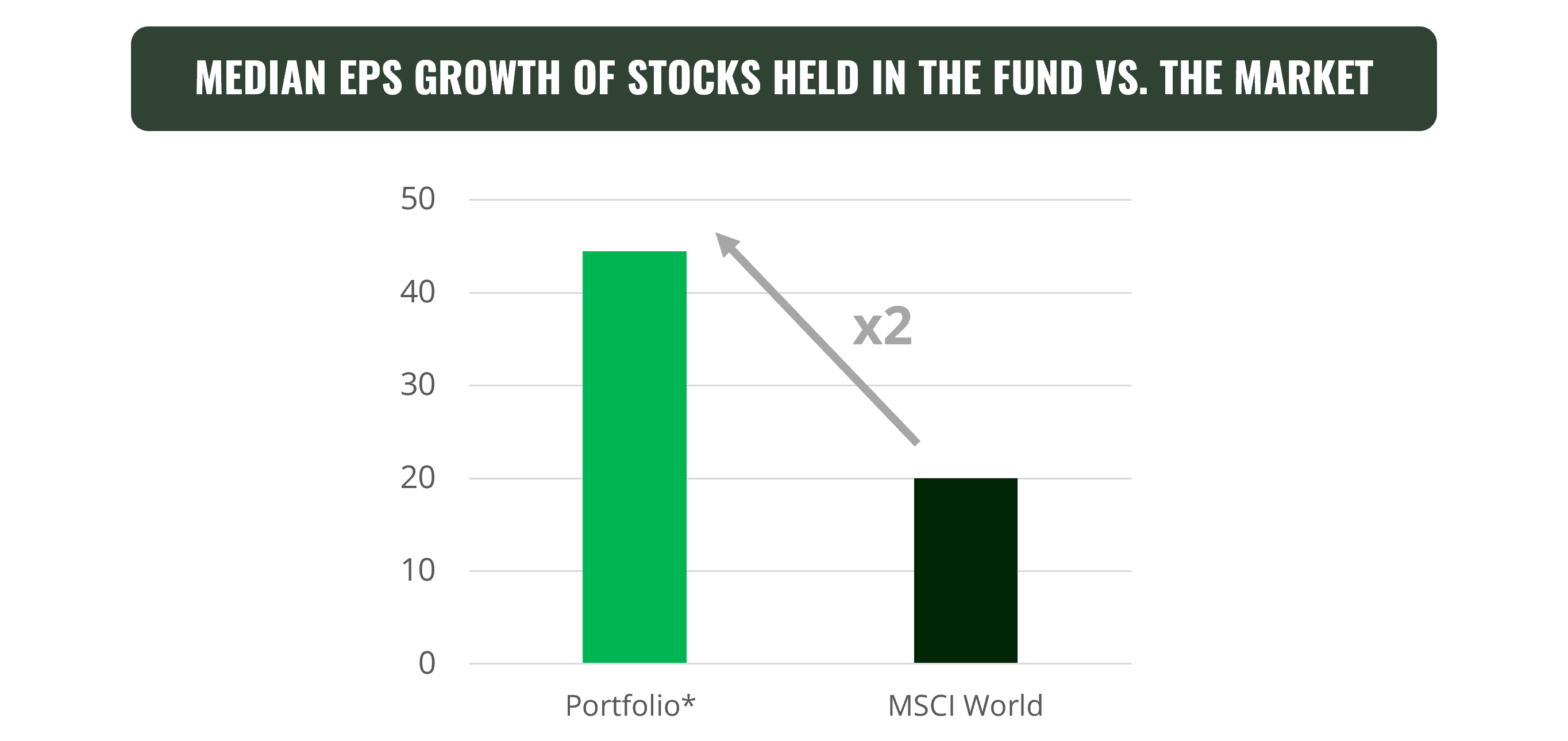

We can observe from the graph above that compounders in the portfolio since launch generate higher average EPS than the MSCI World, reflecting potential better profitability over the long term. In this way, the Fund benefits from the compounding effect.

An experienced portfolio management team

FP Carmignac Global Equity Compounders is managed by two experienced fund managers: Mark Denham and Obe Ejikeme. With 31 and 19 years of investment experience respectively, they manage more than £770 million of assets under management between them. Their complementary expertise – Mark Denham is renowned for his fundamental approach and Obe Ejikeme for his quantitative analysis – enables the Fund to benefit from a robust process to unearth compounders.

A non-benchmarked high-conviction portfolio

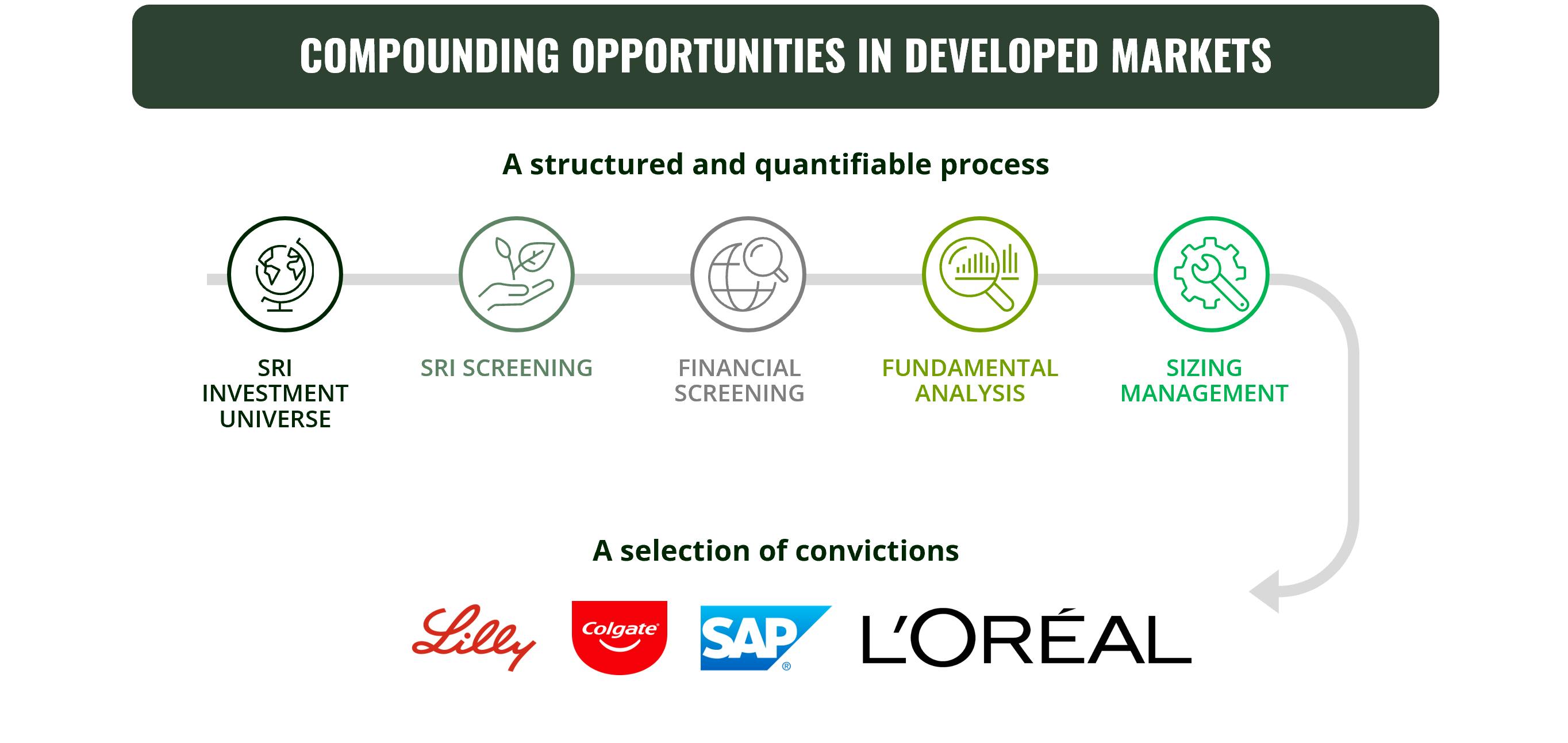

Thanks to its structured and quantifiable process, FP Carmignac Global Equity Compounders identifies companies that possess the ability not only to grow their earnings consistently over time but also to effectively execute their strategies due to their operational excellence. This enables us to build up strong convictions while optimising their weight based on the economic cycle to form a concentrated portfolio of 41 stocks with an active share of 85% at the end of June 2023.

Eli Lilly, Colgate, SAP or L’Oréal – for examples – have demonstrated their resilience by adapting their business model to changes in their environment over time. Their ability to adapt and continue to invest, even in difficult times, makes them major players in their sectors. The same ability can also lead them to maintain their position in the future.

A sustainable global equity Fund

By investing in compounders, FP Carmignac Global Equity Compounders aims to achieve

long-term outcomes and therefore build a legacy not only for the investors themselves, but also one that can be passed on from one generation to the next.

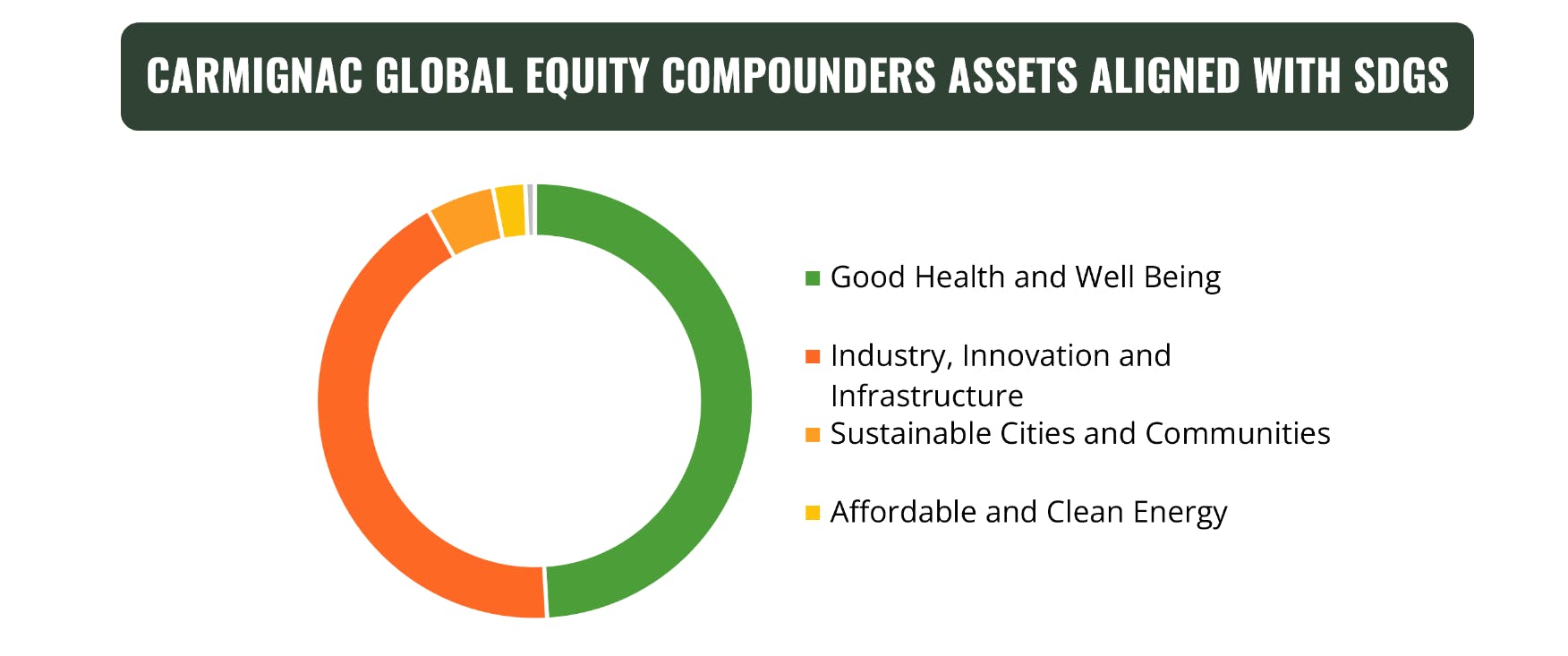

With this objective of transmission through the generations, we are convinced that, as investors, it is our responsibility to create value for our clients through a sustainable approach, and to have a positive footprint for future generations. We strive to identify firms generating positive change based on the Sustainable Development Goals (SDGs) defined by the United Nations.

The Fund also aims to reduce its carbon emissions relative to its reference indicator (MSCI WORLD, USD, Reinvested Net Dividends).

A long-term investment solution

On its third anniversary, FP Carmignac Global Equity Compounders has posted a solid annualised net performance since launch, outperforming its Morningstar category, which puts the Fund in the top quartile since the start of 2023, over 1 year, 3 years and since launch. This positive performance is underpinned by the sound business models in which the Fund invests, which generate positive underlying results over the long term, a further example of the benefits of compounding.

FP Carmignac Global Equity Compounders is a fund designed to withstand different market situations over the long term. Given the economic slowdown taking shape, the Fund appears to be well positioned thanks to its focus on quality companies that are generating positive and foreseeable cash flows regardless of economic growth.

FP Carmignac Global Equity Compounders A GBP ACC

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

FP Carmignac Global Equity Compounders A GBP ACC

| 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|

| FP Carmignac Global Equity Compounders A GBP ACC | - | +23.05 % | +22.62 % | -19.02 % | +20.98 % | +16.14 % |

| Reference Indicator | - | +19.85 % | +22.94 % | -7.83 % | +16.81 % | +12.69 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| FP Carmignac Global Equity Compounders A GBP ACC | +8.13 % | - | - |

| Reference Indicator | +10.08 % | - | - |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Maximum subscription fees paid to distributors : | 0,00% |

| Redemption Fees : | 0,00% |

| Ongoing Charges : | 0.90% |

| Conversion Fee : | - |

| Management Fees : | 0,82% |

| Performance Fees : | 0,00% |