Flash Note

Investing for tomorrow with FP Carmignac Global Equity Compounders

Why focus on quality stocks?

- Published

-

Length

5 minute(s) read

When considering long-term investments, the notion of a quality company is frequently mentioned. Nevertheless, defining it accurately can prove challenging, and its interpretation may differ among investors. Indeed, no one would claim to invest in poor quality companies. At Carmignac, we strive for the most objective definition possible, based on two key concepts: profitability and the reinvestment of profits for future growth. Convinced that it is our responsibility to create both financial and extra-financial value for our clients and future generations, FP Carmignac Global Equity Compounders aims to seize the potential offered by quality stocks, which we also call Compounders.

-

FP Carmignac Global Equity Compounders, a fund focused on quality, sustainable companies

FP Carmignac Global Equity Compounders is a global equity fund launched in 2020 with the aim of capturing the performance of Compounders, high-quality stocks, while adopting a sustainable approach.

Investing in Compounders reflects the aspiration we share with our clients of preserving and passing on their capital over time. To do this, we identify Compounders, quality companies that are capable of weathering different economic cycles. This adaptability and resilience enable the Fund to achieve its objective of helping investors to accumulate a long-term wealth.

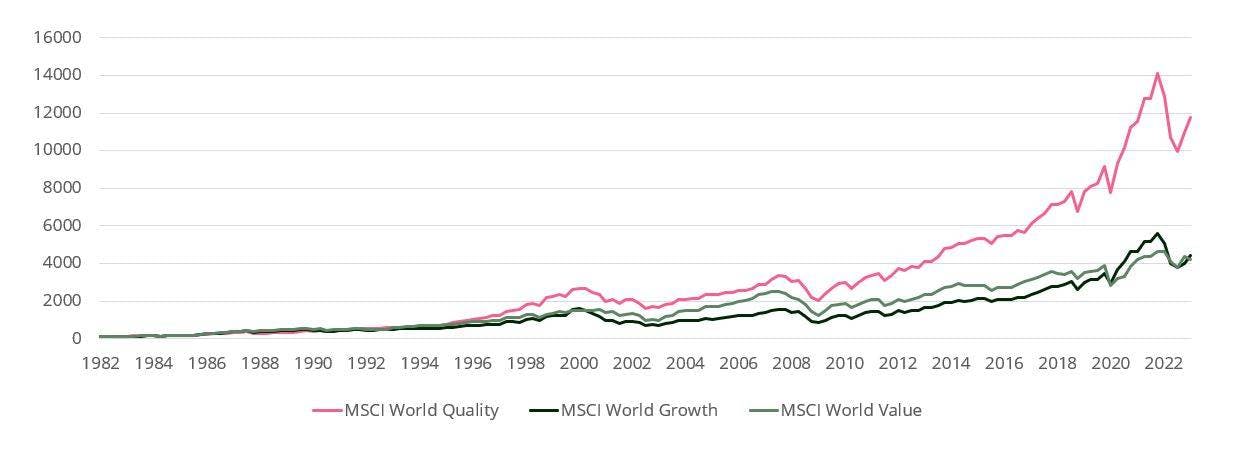

Performance of the MSCI World Quality against the MSCI World Growth and MSCI World Value since its inception in 1982:

Source: Carmignac, Bloomberg, 2023.

Carmignac’s specific approach to quality

At Carmignac, we believe that investing in high-quality companies can provide opportunities. To identify them in different market conditions, Mark Denham, head of European equities and fund manager, developed an objective approach more than 20 years ago based on historical data and concrete characteristics.

This investment process has proved its worth. It is based on two specific criteria: high and sustainable profitability, and reinvestment of earnings to support future growth. By reinvesting capital internally rather than paying dividends, these companies create additional growth drivers, through innovation or product development for example, which enables them to grow and last over time. This investment style is implemented in several funds in our range, and particularly in FP Carmignac Global Equity Compounders. This approach demonstrates our commitment to helping investors build sustainable capital that will benefit not only themselves, but also future generations.

However, we think it's important to include non-financial criteria when defining high-quality stocks. At Carmignac, we are convinced that a quality company should have a positive contribution on the environment and society. We believe that companies with high standards in terms of sustainable development can look forward to more promising long-term prospects.

Investing now for tomorrow

The macroeconomic context of recent years has raised queries among investors about the consequences of inflation's resurgence and the sharp increase in interest rates on global economies and businesses. The current economic slowdown is prompting investors to favour quality stocks and sectors - considered by many to be more resilient. These companies are often less indebted and have solid balance sheets. They can therefore continue to finance new projects without incurring excessive debt costs and maintain attractive margins.

We believe that forward-looking sectors offer opportunities, such as healthcare which combines short-term resilience with long-term growth prospects. However, we mustn't lose sight of the fact that for a long-term investor, it's always a good time to invest in quality equities!

-

Convinced that healthcare and consumer staples are structurally high-quality sectors

Defensive sectors are less sensitive to the different phases of the economic cycle. This is particularly true of healthcare and consumer staples stocks. Innovation is an integral part of the way these sectors operate. The healthcare industry must continually find solutions to the health challenges brought by demographic changes, such as a growing and ageing population, while the consumer sector is regularly confronted with arising needs related to new ways of life.

Novo Nordisk, a century of medical innovation

Within FP Carmignac Global Equity Compounders, we have a strong conviction in Novo Nordisk, a Danish pharmaceutical company. Novo Nordisk reinvests a significant part of its profits in research to develop treatments for the growing number of chronic diseases linked to urban lifestyles. The company is one of the pioneers in the fight against diabetes, introducing insulin to the market in 1923.

Procter&Gamble, a heritage of avant-gardists

Procter&Gamble is an American company in the consumer staples sector. It is another conviction in our portfolio as, since 1837, it has been able to innovate both through its products and its marketing. Whether in the sanitary sector, with the invention of a decongestant ointment in 1894 or a disposable nappy in 1961, or in the household care sector, with softening sheets in 1973 to accompany the growing use of tumble dryers, the company has been able to take advantage of its research and development laboratory to meet the changing needs of households.

We are convinced that, in this uncertain macroeconomic environment, quality companies remain the preferred choice. Using its expertise, FP Carmignac Global Equity Compounders has been able to identify companies that generate long-term profitability. This specific approach of quality investing enables investors to prepare for their own future, as well as that of their progeny.

Key messages

FP Carmignac Global Equity Compounders A GBP ACC

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

FP Carmignac Global Equity Compounders A GBP ACC

| 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|

| FP Carmignac Global Equity Compounders A GBP ACC | - | +23.05 % | +22.62 % | -19.02 % | +20.98 % | +16.14 % |

| Reference Indicator | - | +19.85 % | +22.94 % | -7.83 % | +16.81 % | +12.69 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| FP Carmignac Global Equity Compounders A GBP ACC | +8.13 % | - | - |

| Reference Indicator | +10.08 % | - | - |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Maximum subscription fees paid to distributors : | 0,00% |

| Redemption Fees : | 0,00% |

| Ongoing Charges : | 0.90% |

| Conversion Fee : | - |

| Management Fees : | 0,82% |

| Performance Fees : | 0,00% |