Flash Note

Make your savings count by investing in sustainable funds

- Published

-

Length

4 minute(s) read

Sustainable funds incorporate environmental, social and governance (ESG) criteria into their investment process. They also offer savers a way to diversify their financial investments while acting in accordance with their principles.

Responsible investment is experiencing rapid growth at present, as investors look for ways to make their savings count by combining economic performance with long-term resilience.

To that end, funds adopting this approach, also known as “sustainable” funds, incorporate environmental, social and governance (ESG) criteria into their investment choices alongside conventional financial assessment parameters (return, profitability, debt levels, etc.).

The investment strategy of sustainable funds

Through their choices, the portfolio managers of these funds finance companies or States contributing to sustainable development. They might, for example, decide to invest in companies that are seeking to combat climate change or that treat their workers particularly well. They may also exclude certain business sectors, such as weapons or tobacco, from their investment universe.

Investing in sustainable funds is about more than just taking action to safeguard the future of the planet. Portfolio managers of sustainable funds select companies with the potential to generate strong economic performance and have a positive impact on the environment, on society or on the way in which they are managed.

A popular approach with savers

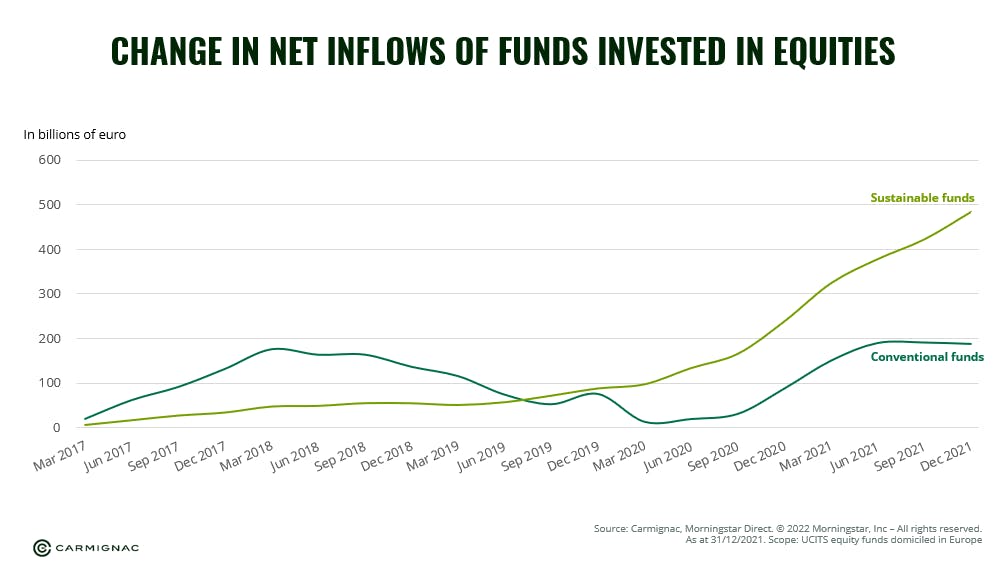

Many savers want their investments to reflect their values and convictions. As a result, sustainable equity funds recorded EUR 483 billion in net inflows (the difference between incoming and outgoing funds) over the five years to the end of 2021. For comparison, conventional funds raised EUR 188 billion over the same period according to data compiled by Morningstar and Carmignac1.

In response to this growing interest, more and more funds are deploying robust SRI strategies aimed at investing on the basis of particular issues (climate change, client and employee satisfaction, etc.), in accordance with their investment theme, their process and the convictions of their portfolio managers. At the same time, regulations have been strengthened in this area, leading to greater awareness and transparency in relation to companies’ social responsibility.

A way to diversify your assets and investments

Investing in sustainable funds also offers savers a way to diversify their investments. The phrase “Don’t put all your eggs in one basket” may be an old saying, but it’s also one of the most cherished and oft-repeated principles in wealth strategy.

Investors are advised to secure their portfolio and optimise performance by mixing various asset classes (equities, bonds, etc.), and they can even seek further diversification within these categories. They may wish to invest in different industries and/or geographical regions, or in companies of differing sizes. Investing sustainably is another aspect of the same process.

No compromising on performance

While economic performance remains at the heart of asset management, studies typically show that sustainable funds are not incompatible with good results.

Global equity funds without precise sustainability criteria (“Article 6” funds2) recorded an annual return of 10.6%, net of fees, between 2019 and 2021. This figure should be compared against +13% for funds with quantifiable sustainable investment objectives (“Article 9” funds2) and +12.5% for funds that promote environmental or social characteristics (“Article 8” funds2), according to Morningstar and Carmignac data from end-March 20223.

Moreover, sustainable funds have a proven ability to withstand crises. According to the Novethic research centre4, in the first half of 2020, at the height of the COVID-19 pandemic, sustainable equity funds only fell by 6.5%, whereas the equities of the 600 largest European companies (STOXX Europe 600 index) dropped 13.5% over the same period.

What Carmignac offers

As independent and active portfolio managers, our mandate is to effectively manage our clients’ savings over the long term. Investing responsibly is intrinsically linked to this aim.

-

To this end:

we forge our own convictions and long-term vision through proprietary quantitative ESG analysis, supplemented by the views of our experts and independent research;

we analyse ESG criteria as part of our investment process because it is an essential part of mitigating risk and identifying opportunities;

we engage in dialogue with the companies in which we invest to encourage them to adopt best practices and a more sustainable profitability model;

we work with industry heavyweights to raise awareness and help foster emancipation, leadership quality and the fight against climate change;

we select companies that make a positive contribution to society and the environment, and exclude players that go against our principles and values from our investment universe;

we assess the negative impacts of our investments on the E, S and G pillars in order to respond to the main challenges associated with sustainable investment.

Furthermore, 90% of our assets under management incorporate environmental or social characteristics or have a sustainable investment objective.

1UCITS funds domiciled in Europe. The EU UCITS (Undertakings for Collective Investment in Transferable Securities) Directive allows financial bodies to move and manage their funds remotely across the EU, subject to compliance with certain transparency procedures and standards.

2The SFDR (Sustainable Finance Disclosure Regulation), in force since 10 March 2021, requires asset managers and investment advisers to publish information on how sustainability risk is taken into account. To this end, the regulation requires asset management companies such as Carmignac to classify their funds on the basis of the objective pursued, and the following three objectives in particular: Article 9 for products with quantifiable sustainable investment objectives at the heart of their investment process; Article 8 for funds that promote environmental and social characteristics; and Article 6 for funds with no sustainability objective.

3UCITS funds domiciled in Europe. The EU UCITS (Undertakings for Collective Investment in Transferable Securities) Directive allows financial bodies to move and manage their funds remotely across the EU, subject to compliance with certain transparency procedures and standards.

4Sustainable fund market indicator, June 2020.