Flash Note

Why is it a good idea to invest your savings?

- Published

-

Length

3 minute(s) read

Reduce the effects of inflation on your savings, your finance projects, and achieve your wealth management objectives: three good reasons to invest your money rather than leaving it in a bank account paying little or no interest.

Faced with the current economic uncertainty, households are building up their “precautionary” savings. This is in addition to the “forced” savings stockpiled since 2020 as a result of the health crisis. The COVID-19 lockdowns meant households were unable to consume, and as a result they saved more than in previous years.

These savings often lie in non-interest bearing bank accounts, to be quickly mobilised in case of an emergency. While understandable, this isn’t necessarily an ideal solution.

Reduce the effects of inflation

This precautionary savings strategy is likely to cost households money. With rising inflation, doing nothing with your savings may prove highly counterproductive, since it exposes savings to depreciation. Inflation has risen sharply in recent months and is eating away at the real value of capital.

According to Eurostat, annual inflation in the Eurozone reached a record high of 8.9% in July 2022. This indicator had reached its previous high of 8.6% in June 2022. While economists expect a slowdown in price rises in the near future – the peak in Europe is expected in December – inflation levels are likely to remain high for some time to come.

Invest early to build up capital

Rather than letting savings lie in a bank account with no return or a return so low that it will be eroded by inflation, households can achieve their wealth management objectives by investing their savings. Investing early in life can increase opportunities to grow capital.

By regularly investing even small amounts of money, from the day they start working, in financial products that tie in with their investment objectives, households can reduce their savings effort over time.

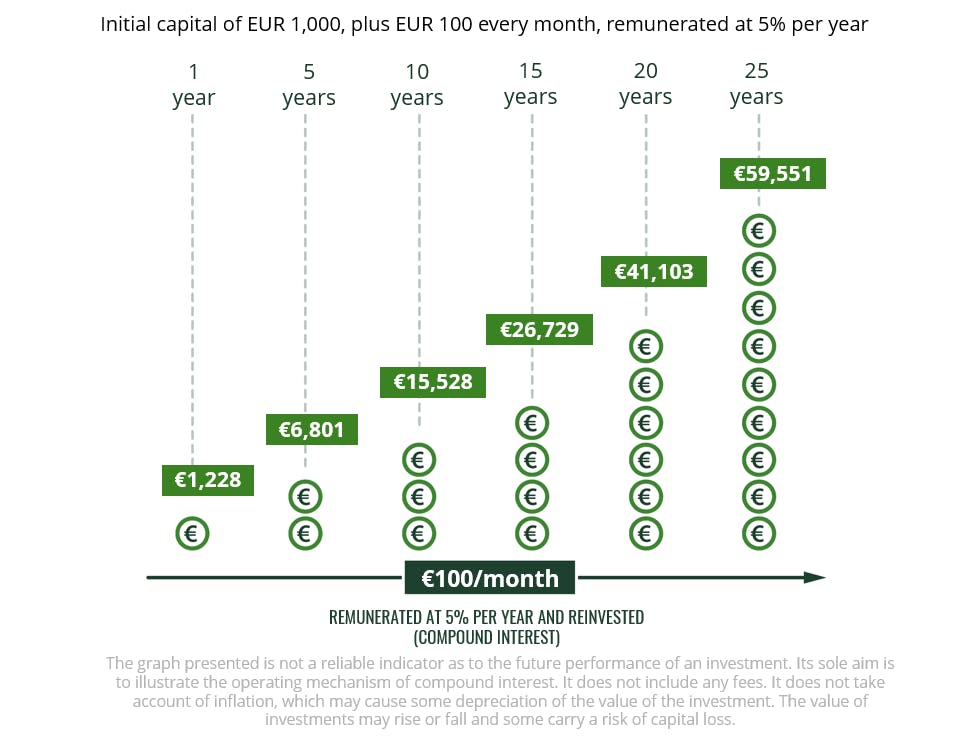

Moreover, the earlier they start, the less effort required. This is all down to compound returns, i.e. the generation of a return on capital initially invested and on the return itself when reinvested. The earlier and more regularly you invest, the more your savings grow.

The beauty of compound returns:

Furthermore, investing early and regularly helps you cope with the uncertainty of the financial markets. It has been shown, e.g. for listed shares, that time favours long-term investments.

Adapt your investment objectives to your profile and plans

Saving allows you to fund real estate projects, finance your children’s education, and prepare for retirement, but also to build up an inheritance for loved ones and to protect them. Saving over the long-term lets investors pursue a range of wealth objectives.

For example, at the beginning of your working life, you may want to finance the purchase of a primary residence. As a result, you’ll prioritise short- or medium-term financial products. Later in life, once you are more established, you may prefer different types of investment, e.g. long-term for retirement or medium-term for the purchase of a second home or to finance your children’s higher education.

-

What Carmignac offers:

To help you start and grow your savings, Carmignac offers a range of diversified funds that are actively1 and responsibly managed to provide you with the best possible returns.

1 Active management entails selecting the financial assets (equities, bonds, currencies, etc.) that will generate the best performance in relative terms, and buying at the right time. By contrast, passive management involves seeking to replicate a stock market index.