Funds in Focus

Carmignac Portfolio Grandchildren is celebrating its 2-year anniversary

Carmignac Portfolio Grandchildren

A SRI Fund aiming to deliver long-term returns through investing in sustainable high-quality compounders.

Deep dive into the fund's philosophy, its 2-year performance, and how we are currently positioned so as to maximize what we believe will come next.

Understand the philosophy

Carmignac Portfolio Grandchildren’s philosophy comes from an almost three-decade-long experience aimed at searching for attractive companies coupled with a responsible approach while mitigating market cycles.

The first pillar of the philosophy focuses on finding companies that today show the characteristics we believe are needed to successfully grow over time. Mark's selection process, successfully tested in other Carmignac strategies, allows him to identify companies that are considered quality businesses with a strong business model. They are typically less leveraged and have high historical margins, making them more cash generative. In turn, this allows them to reinvest internally. This is key for us as we look for companies that reinvest most of their profit to keep innovating, as to ensure their activity stays relevant over time.

Responsible investment is fully integrated into this investment process and is part of our objective to capture companies with attractive long-term prospects.

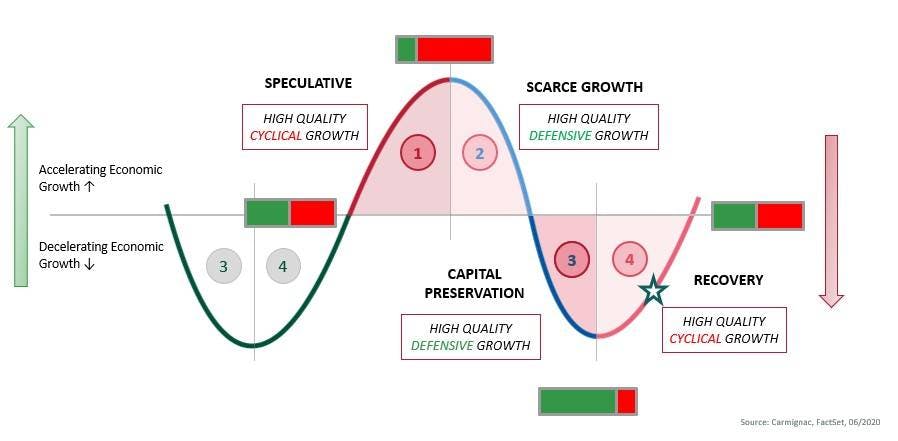

The second pillar leverages on a quant analysis to fine-tune the end portfolio by adjusting its cyclicality based on the direction of the economic cycle.

By managing the cyclicality, Mark and Obe can, rather than flipping over the entire book when a cycle rotation is brewing, skillfully adjust the sizing of their positions, tilting the portfolio in a more cyclical or defensive way, based on their view of the cycle.

Thanks to a well-oiled investment process, the strategy is living up to its promises, exhibiting a strong track record, despite particularly complex and volatile markets. The result is a true long-term strategy, substantiated by an SRI lens and an ESG approach integrated into their investment process.

The fund also obtained the French and Belgian sustainability labels :

|

SRI Label www.lelabelisr.fr/en |

|

Towards Sustainability label www.towardssustainability.be |

Performance review

Many of our core long term quality prospects that delivered for us since launch have continued well into 2021:

IT and Media have contributed positively across the board. Many of these are well known names among semiconductor sector ASML/Nvidia, media leaders Alphabet/Facebook, and Microsoft, but also Intuit – software for personal/SME accounting and tax, growing market share in English speaking countries

Consumer names – staples and discretionary - have been positive. Estee Lauder, the US luxury cosmetics company, is a pure-play on prestige cosmetics and allows to benefit from prestige brands taking share from mass-market as well as under penetration in emerging markets

Industrials were strong contributors in this environment – such as US company Sensata Technologies – one of the world’s leading manufacturers of industrial sensors/switches. The company benefits from its high exposure to automotive industry where the transition to electric vehicles boost market growth for sensors.

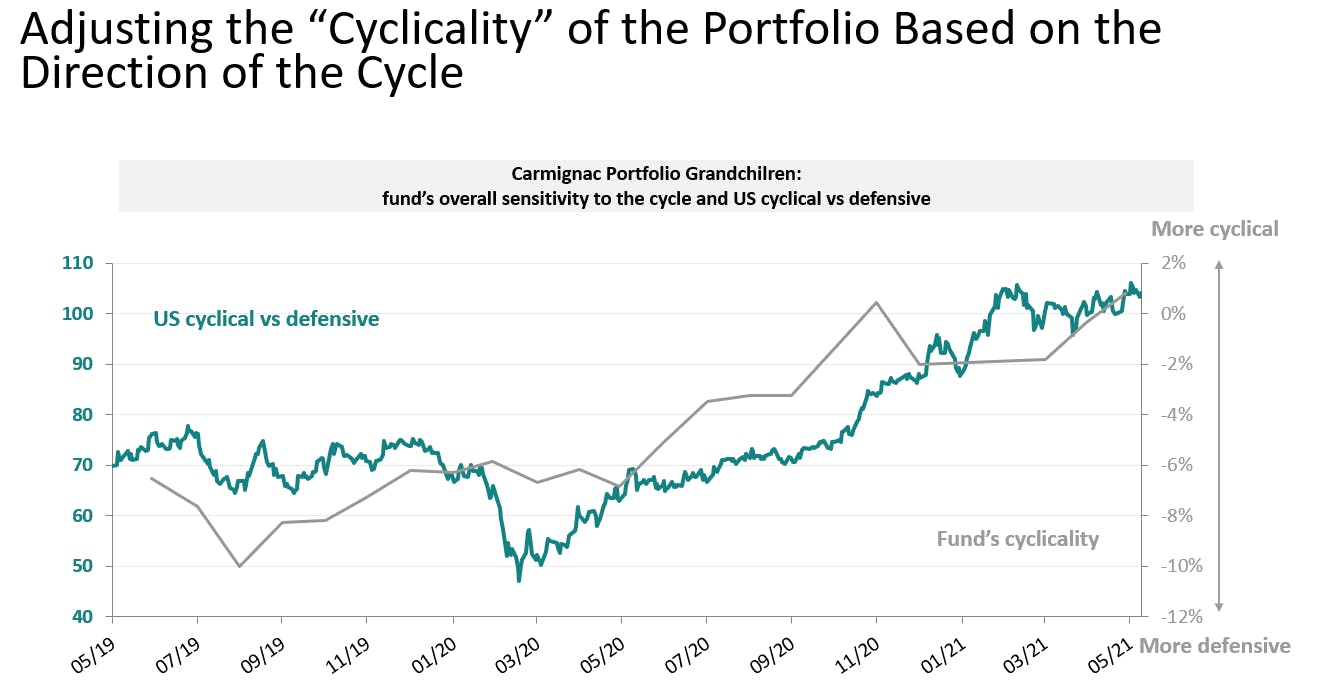

Up until May 2020, our portfolio had been mainly tilted towards more defensive quality companies, in a context of slowing growth all around the world. As earning’s growth expectation reached a trough in the middle of last year, we decided to steadily increase the weight of our most cyclical names and so somehow reshaped our portfolio. This cyclical rebalancing allowed us to mitigate the impact of the sector rotation that has been taking place since the end of 2020. As shown in the chart, adjusting the weights of the holdings based on our view of the cycle it is at the core of our strategy.

What will come next ?

Higher inflation expectations in developed countries have started lifting interest rates from their ultra-low levels, especially in the US, where the rapid reopening of its economy is overlapping with large fiscal and monetary support. As a result, once markets will have fully integrated the economic recovery, they will shift back their focus on companies’ fundamental, benefiting quality stocks.

Our strategy prioritizes investments in companies that we think offer the most attractive long-term prospects. We currently find more quality convictions in the healthcare, technology, consumer and industrial space. Conversely, the strategy has underweighted the energy and financial sectors, where companies usually exhibit a high level of debt or low profitability.

We do not intend to keep switching our holdings unless a deterioration in the company’s business model or competitive environment forces us to withdraw. SRI and ESG considerations are also focal to our thesis. Therefore, the portfolio’s structure is largely unchanged. However, we continue to fine-tune some of our holdings to reflect an improvement in medium-term macroeconomic data.

Carmignac Portfolio Grandchildren A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

*Carmignac Portfolio Grandchildren was launched on May 31st, 2019.

Source: Carmignac, Bloomberg, 31/05/2021. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor). The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

© 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

![[ISR pages] Picto Engage [ISR pages] Picto Engage](https://carmignac.imgix.net/uploads/logo/0001/13/b971f963ade4ea65effca9688bba05cf5fb1952b.png?auto=format%2Ccompress)

![[ISR pages] Picto Analyse [ISR pages] Picto Analyse](https://carmignac.imgix.net/uploads/logo/0001/13/73bf16da363dd0316cf00942970087a4f91559a8.png?auto=format%2Ccompress)