Funds in Focus

Reinvest is best

Discover FP Carmignac Global Equity Compounders

- Published

-

Length

4 minute(s) read

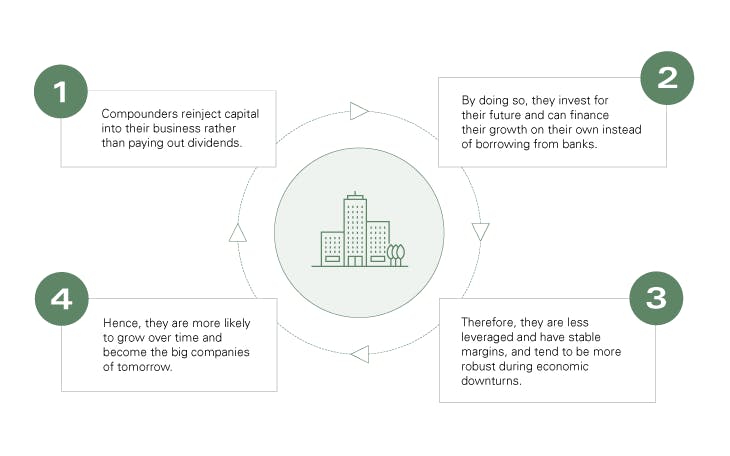

Compound interest has been called the 8th wonder of the world. The good news is that more than interest can be compounded. Profitable companies choosing to reinvest their earnings sustainably for future growth can have an equally powerful long-term effect.

We call them Compounders.

The magic of Compounders

Taking advantage of their long-term effect

Discover FP Carmignac Global Equity Compounders, a “buy and hold” investment solution investing in shares of sustainable, high-quality companies across the world. The Fund aims to deliver long-term returns over a recommended investment period of at least five years – but investors can choose to hold it for a lifetime.

Hear from the Fund Managers themselves :

FP Carmignac Global Equity Compounders invests in what we think are the best bets for long-term sustainable growth – the Compounders – and it does so while mitigating the effects of changing economic cycles. In following these long-term goals, the Fund Managers always keep an eye on the road: in addition to a rigorous stock selection, they optimise the portfolio by adjusting the sizing of their positions to cyclical and defensive stocks according to the direction of the cycle.

The Fund seeks to achieve steady capital growth over the long term for UK investors looking to put their capital to good use – and to have a team of investment professionals handling the process for them.

Our Compounders revealed

The result of the strong and rigorous investment process of FP Carmignac Global Equity Compounders is a low-turnover, concentrated portfolio of ~40 high conviction names. Discover some of the high quality, sustainable companies which made it into our portfolio:

Source: Companies’ websites, Bloomberg, 2021.

FP Carmignac Global Equity Compounders A GBP ACC

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

FP Carmignac Global Equity Compounders A GBP ACC

| 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|

| FP Carmignac Global Equity Compounders A GBP ACC | - | +23.05 % | +22.62 % | -19.02 % | +20.98 % | +16.14 % |

| Reference Indicator | - | +19.85 % | +22.94 % | -7.83 % | +16.81 % | +12.69 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| FP Carmignac Global Equity Compounders A GBP ACC | +8.13 % | - | - |

| Reference Indicator | +10.08 % | - | - |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Maximum subscription fees paid to distributors : | 0,00% |

| Redemption Fees : | 0,00% |

| Ongoing Charges : | 0.90% |

| Conversion Fee : | - |

| Management Fees : | 0,82% |

| Performance Fees : | 0,00% |