Quarterly Report

![[Main Media] [Fund Focus] [CP Campaign] [Main Media] [Fund Focus] [CP Campaign]](https://carmignac.imgix.net/uploads/article/0001/12/962710ad24598a4639b310c980e6eb66eb369433.png?auto=format%2Ccompress)

Carmignac Patrimoine: Letter from the Fund Managers

Market environment

During the second quarter, equity markets continued their robust advance (+6.04%) under renewed growth stock leadership, while the dollar fell (-0.85%) and bonds rallied modestly (+0.84%). This stands in contrast to the first quarter’s market drivers, when bonds suffered their worst quarterly return since 1987 (-3.15%), the dollar rose (+3.66%), and a similarly strong equity advance (+8.39%) was driven by the more cyclical value segment.

Carmignac Patrimoine benefited from its balanced positioning across regions, asset classes, and themes with performance primarily driven by both secular growth and reopening equities, but also by credit investments in corporates and emerging sovereigns, as well as dollar and yen currency hedging. This performance was restrained somewhat by conservative exposure management across both equities and core duration. Among our top equity contributors of the quarter, we note Hermès, as well as Alphabet and Facebook. Across our top contributors on the fixed income side, the Chinese government bond market advanced +1.34% during the quarter, bringing year-to-date returns to +2.23% versus -2.34% for developed markets. China’s strongly positive real rates and conservative policy mix stand in stark contrast to the financial repression in western markets. Romania and quasi-sovereign energy credits such as Pemex and Gazprom also drove returns, benefiting from improving underlying fundamentals and attractive spreads from mispriced political risks.

On the other hand, performance was constrained during the quarter because of lagging Chinese equity markets and conservative exposure management. Although we benefited from the delayed rise in rates in German bond markets due to their Europe’s delayed vaccination and reopening schedule, we were penalised by our short exposure in the US Treasury market. US ten-year yields declined during the quarter from 1.74% to 1.47%, as expectations for the next phase of Biden’s fiscal spending were reduced, the Fed hinted at allowing a shorter and shallower inflation overshoot than the market had priced, and the delta variant impacted economies with lower vaccination rates and higher reliance on tourism.

Portfolio allocation

A desynchronised global recovery continues to unfold, with differences in the pace of vaccination and government policy support driving relative performance across economies and capital markets. While current robust activity levels in developed markets have been supported by the reopening of economies and highly stimulative monetary and fiscal policies, the shift in market internals from the first to second quarter shows a reduction of medium-term growth and inflation expectations as markets adjust to the reality of a reduced political will in the United States to continue fiscal and monetary policy support, and a slower eradication of Covid worldwide.

Overall, our equity exposure remains high (43%) as the outlook for equity markets is constructive, with a sustainably high inflation scenario receding thanks to a more vigilant Fed. Secular growth stocks should benefit from this environment especially at a time when overall corporate earnings growth will decelerate, making their steady growth relatively more attractive. In addition, the probability of sharp US tax increases is decreasing as fiscal spending seems to be curtailed somewhat by an increasingly divided Democratic Party.

In the short-term, US activity will remain well above trend and a closed output gap will pressure wages higher. Current strong inflation driven by unsustainable reopening demand and supply constraints will abate, but towards the end of the year more persistent inflationary pressures might surprise. If housing market strength and rental market tightness begin to feed through into shelter CPI (Consumer Price Index), there will be further pressure on the Fed to tighten earlier and faster. Less fiscal and monetary policy support justifies lower medium-term growth and inflation expectations, flatter curves, and additional support for the dollar. In this context, we have increased our overall duration (from -150 basis points at the end of Q121 to 52 basis points) and US dollar exposure (from 26% to 28%). Our main government bond exposures are in jurisdictions with substantial ability to ease policy, for example China; and where there is little pressure to tighten policy because of persistent output gaps and modest inflation, for example in Europe. Our corporate and emerging market spread product ought to perform well in this environment.

Outlook

Our equity investment process revolves around identifying promising secular trends in order to invest in companies that show strong growth regardless of economic conditions. As we enter the second half of 2021, we continue to pay particular attention to stocks with high valuation multiples in an environment of potential rate hikes. We have therefore weighted the portfolio towards growth stocks offering valuations that we judge reasonable, and which can be found among certain mega-caps such as Facebook and Google.

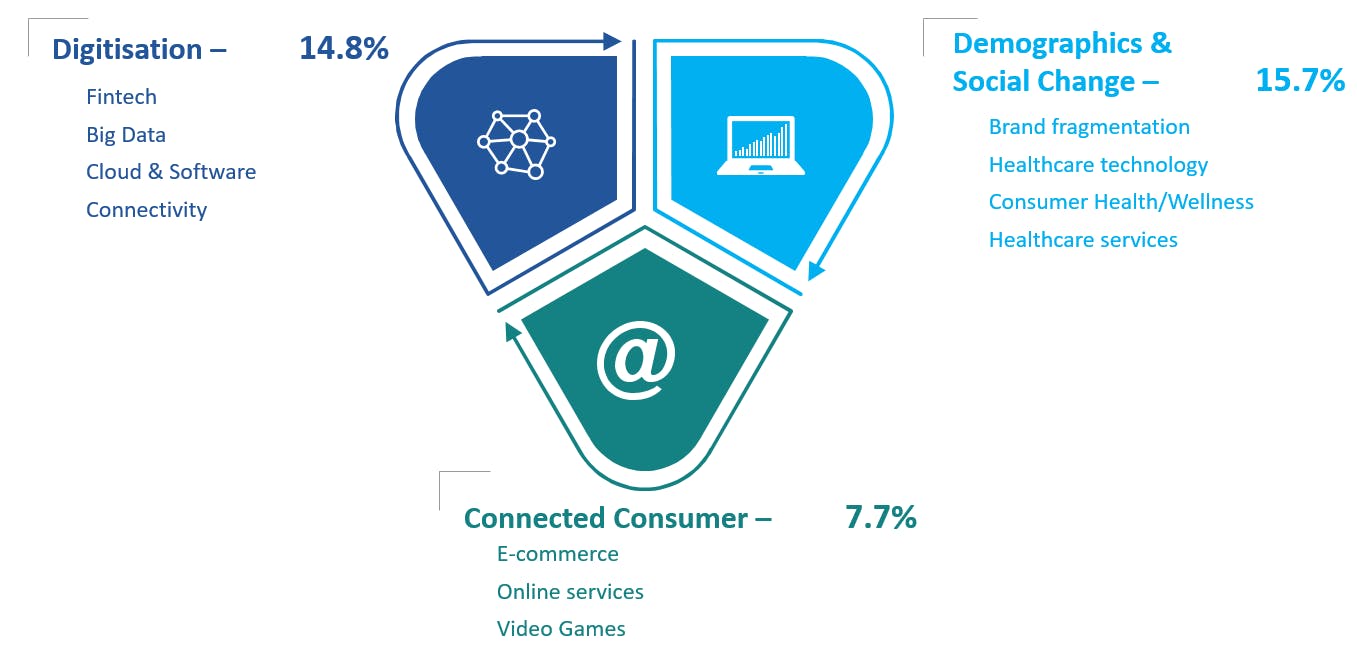

Overall, we maintained a liquid and solid equity portfolio of strong conviction investments, diversified in terms of geography, sectors and themes. Our core thematics currently revolve around:

Gold: 3.7%

Others: 4.8%

Carmignac Patrimoine A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | +8.81 % | +0.72 % | +3.88 % | +0.09 % | -11.29 % | +10.55 % | +12.40 % | -0.88 % | -9.38 % | +2.20 % | +7.06 % |

| Reference Indicator | +15.97 % | +8.35 % | +8.05 % | +1.47 % | -0.07 % | +18.18 % | +5.18 % | +13.34 % | -10.26 % | +7.73 % | +5.28 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | -1.70 % | +2.69 % | +1.93 % |

| Reference Indicator | +2.59 % | +5.21 % | +6.39 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Maximum subscription fees paid to distributors : | 4,00% |

| Redemption Fees : | 0,00% |

| Ongoing Charges : | 1.87% |

| Conversion Fee : | 0% |

| Management Fees : | 1,50% |

| Performance Fees : | 20,00% |

Carmignac Patrimoine A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.

Source: Carmignac, 30/06/2021.