Quarterly Report

FP Carmignac Emerging Markets: Letter from the Fund Managers

- Published

-

Length

5 minute(s) read

-

1.5%Relative performance of FP Carmignac Emerging Markets A GBP Acc

versus its comparator benchmark MSCI Emerging Markets NR Index.

-

18.3%Of the current portfolio

is invested energy transition and renewable industries.

-

64.0%Exposure of Fund

to companies aligned with SDGs and sustainable themes.

FP Carmignac Emerging Markets was down –2.55% in the second quarter, compared with a –4% decline in its comparator benchmark. Year to date, the Fund has delivered a performance of –12.06%, versus –8.13% for its comparator benchmark. During the first half of 2022, emerging-market equities continued the slide that started in early 2021. This downturn stemmed from decisions made by the world’s main central banks – particularly the Fed and the ECB – to start normalizing monetary policy after years of quantitative easing. The war in Ukraine also led to a dual shock, with impacts on food and energy prices. The combination of these two factors is creating formidable headwinds, as the resulting inflation is forcing central banks to adopt a strict policy stance that’s highly detrimental to equity markets.

What exactly happened in emerging markets in Q2 2022?

The positive surprise in Q2 came from China. Its stock market rebounded sharply and outperformed all major emerging and developed-world markets, despite the severe lockdowns introduced in some large Chinese cities. Xi Jinping’s zero-Covid strategy led to a chaotic implementation of lockdowns in Shanghai, Beijing, and many other regions. The country’s GDP contracted significantly in April and May but bounced back in June after Beijing loosened its Covid restrictions. China undoubtedly handled the pandemic relatively well during the first strain and the Delta variant, but now the highly contagious Omicron variant appears to be making the zero-Covid strategy much less effective with a stronger impact on the economy. It’s unlikely Xi Jinping will make any material changes to the strategy before the National Congress in the fourth quarter which should see him elected to a third term. However, Beijing has had some success in controlling the pandemic – it was able to contain the spread of the virus and reboot China’s economy through an array of stimulus measures that encompass infrastructure building, financial assistance for consumers, support for the automotive industry, and various tax cuts. Chinese equity investors welcomed these developments, and our Fund was able to benefit considerably from the rally in stock prices given our high exposure to China (38% of the Fund’s assets1). As we mentioned in our previous quarterly report, Chinese equity valuations had become very attractive following the steep decline in 2021, which was triggered by Beijing’s regulatory crackdown on the new economy, and Russia’s invasion of Ukraine. We stressed that we’ve been shoring up our positions in companies with a market capitalisation equal to less than their cash on hand. That’s what we did with New Oriental, for example, an education company whose stock price has doubled since mid-May2.

We added a new Chinese company to our portfolio in Q2: Full Truck Alliance. This firm runs a digital marketplace that matches up truck drivers and shippers, allowing businesses to schedule optimal shipping routes and prevent trucks from making return trips empty. Because shipping supply and demand is highly fragmented in China, there’s a need for this kind of marketplace, and Full Truck has a dominant 65% market share3. Our analysis indicates that the company’s business model requires little capital expenditure, offers a high return on equity, and holds promising growth prospects. Its stock had become priced very attractively, given that its cash on hand is equal to over a third of its market cap.3 Known as China’s "Uber of Trucks", the company aims to transform China’s road transportation industry by pioneering a digital, standardized, and smart logistics infrastructure across the value chain. The nature of its services is environmentally friendly as the business helps significantly save transportation cost versus traditional business models. The Company makes a positive impact on the environment by eliminating empty miles and wasted fuel. According to the company’s estimates, in 2020 they helped reduce carbon emissions by 330,000 metric tons as a result of a smarter logistics infrastructure. On the Social front, by improving supply/demand efficiency among shippers and trucks, and reducing idle time and wasted mileage, the business helps drivers to improve their productivity and their ability to manage their driving uptime, routing and safety.

Adjustments and current positioning

We took advantage of the turbulence in equity markets to focus our portfolio more heavily on our strongest convictions. We had just 34 holdings as of 30 June (not including the two Russian companies still in our portfolio which we can’t sell and are marked in our books at close to zero) – a level of concentration that’s never been seen before in the Carmignac Emergents Fund. This reflects our intention to pursue a highly active investment approach based on strong convictions. We believe that stock-market downturns provide opportunities to benefit from market inefficiencies, which are particularly pronounced in emerging markets.

Outside China, we believe the most attractive equity valuations can be found in South Korea (16% of the Fund’s assets). As the country’s stocks are (correctly) viewed as being cyclical, they were recently sold off on a large scale by global asset managers, resulting in downwards pressure that local institutional investors haven’t been able to offset. In addition, many South Korean retail investors had to meet margin calls that forced them to liquidate their positions. The country’s stocks are now trading at levels consistent with a lasting slump in global demand. However, most of our South Korean investments are in companies operating in secular growth themes like semiconductors. Demand for these electronic components is being fuelled by the digital revolution and the voracious appetite it’s creating for RAM to run datacentres and cloud-computing servers. The electrification of vehicles is another driver of semiconductor demand, and self-driving cars will be too in the coming years. Cars sold worldwide in 2025 are expected to require twice as many semiconductors on average as those sold in 2021. Samsung Electronics (8.3% of the Fund’s assets) is a global leader in semiconductor fabrication – yet is trading at less than four times operating profit, even though it has $120 billion of cash on its balance sheet. LG Chem (3.6% of the Fund’s assets) is a global leader in batteries for electric vehicles and its preferred stock is priced at less than five times operating profit4.

Our investments in Latin America (14% of the Fund’s assets) lost value in Q2 on the back of the drop in commodities prices – which weighed on the Brazilian real and the Mexican peso – and the bleaker growth prospects for these two countries’ economies. Our investments in Brazil and Mexico are focused mainly on domestic demand and on growth themes like finance (Banorte, B3 Bolsa), healthcare (Hapvida), the digital economy (MercadoLibre), and energy (Taesa, Isa Cteep). We’re optimistic about how markets will react to Brazil’s presidential election in October, as it should bring a moderate alliance into power and reduce political risk in the country. India (8.9% of the Fund’s assets) appears vulnerable in light of the high oil prices and the country’s record trade deficit. We therefore introduced temporary hedges to protect against a depreciation of the rupee.

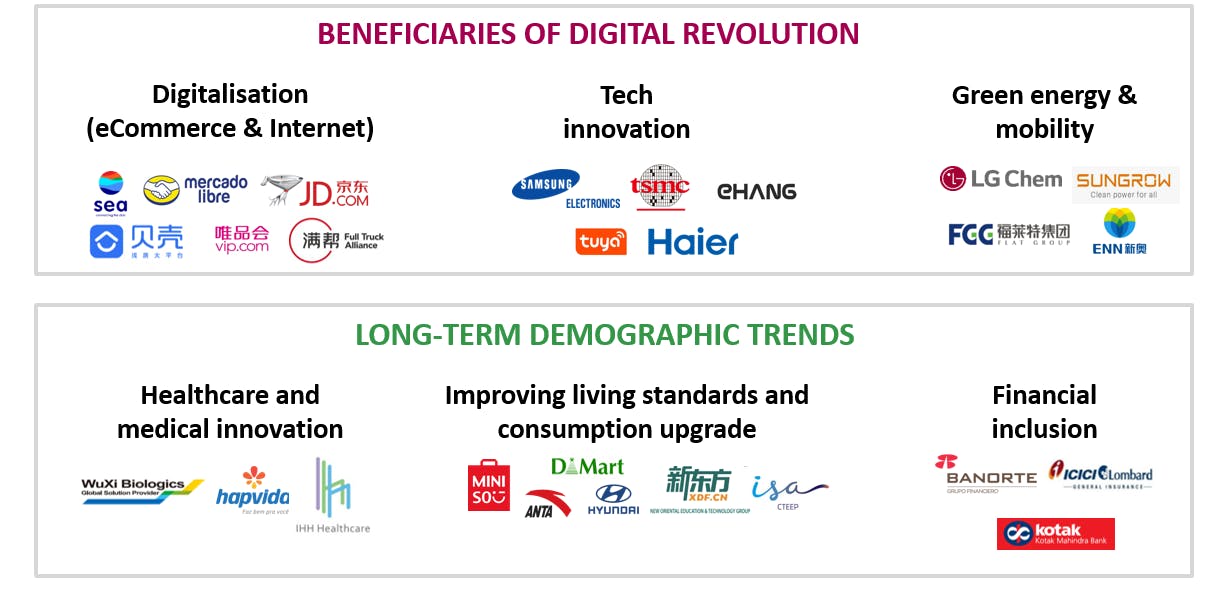

Focus on Beneficiaries of Digital Revolution & Long-Term Demographic Trends

Thematic allocation as of 30/06/2022

Sources: Carmignac, Company data, 30/06/2022

Carmignac's portfolios are subject to change at any time.

1Average exposure of the Fund to China over the second quarter 2022

2Performance of New Oriental in USD from 16/05/2022 to 30/06/2022, source : 30/06/2022

3Source: Company data, Bloomberg as of 31/03/2022

4Source: Company data, Bloomberg as of 30/06/2022

FP Carmignac Emerging Markets A GBP ACC

| 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|

| FP Carmignac Emerging Markets A GBP ACC | +13.57 % | +63.02 % | -15.59 % | -9.45 % | +7.19 % | +2.78 % |

| Reference Indicator | +8.77 % | +14.65 % | -1.64 % | -10.02 % | +3.63 % | +8.39 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| FP Carmignac Emerging Markets A GBP ACC | -5.93 % | +7.83 % | - |

| Reference Indicator | -2.22 % | +3.23 % | - |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Maximum subscription fees paid to distributors : | 0,00% |

| Redemption Fees : | 0,00% |

| Ongoing Charges : | 0.95% |

| Conversion Fee : | - |

| Management Fees : | 0,87% |

| Performance Fees : | 0,00% |

FP Carmignac Emerging Markets A GBP ACC

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.